CA DE 938 2014-2024 free printable template

Show details

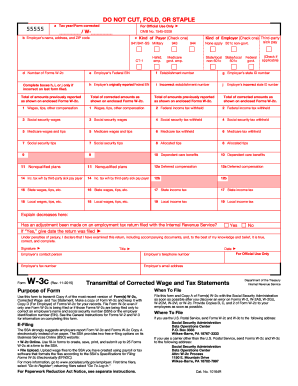

B. UNEMPLOYMENT INSURANCE (UI) Taxable Wages ................. C1. .... Quarterly Adjustment Form for Voluntary Plan Disability Insurance Employers (DE 938).

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your de9adj form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your de9adj form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing de9adj online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit de9adj instructions form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out de9adj form

How to fill out de9adj?

01

Gather all necessary financial information, including payroll records, tax forms, and employee information.

02

Review the instructions provided with the de9adj form to ensure you understand how to accurately complete it.

03

Fill in the required sections of the form, such as company information, payroll tax details, and adjustments being made.

04

Double-check all the information entered to avoid any errors or mistakes.

05

Sign and date the form before submitting it to the appropriate tax authority.

Who needs de9adj?

01

Businesses or employers who need to make adjustments to their payroll tax reports filed with the state tax agency.

02

Employers who have identified errors, discrepancies, or changes in their reported payroll taxes and need to correct them.

03

Companies that have undergone mergers, acquisitions, or restructuring and need to account for any adjustments related to payroll taxes.

04

Employers who have received a notification from the tax authority requesting a de9adj form to address specific issues or concerns.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is de9adj?

DE9adj is a type of DJ mix released by Richie Hawtin, a Canadian electronic musician and DJ. It stands for "DE9: Closer to the Edit" and is a highly influential mix album that showcases Hawtin's skill in live remixing and manipulating multiple tracks simultaneously. DE9adj is known for its intricate layering of tracks and seamless transitions, often blurring the lines between different genres of electronic music.

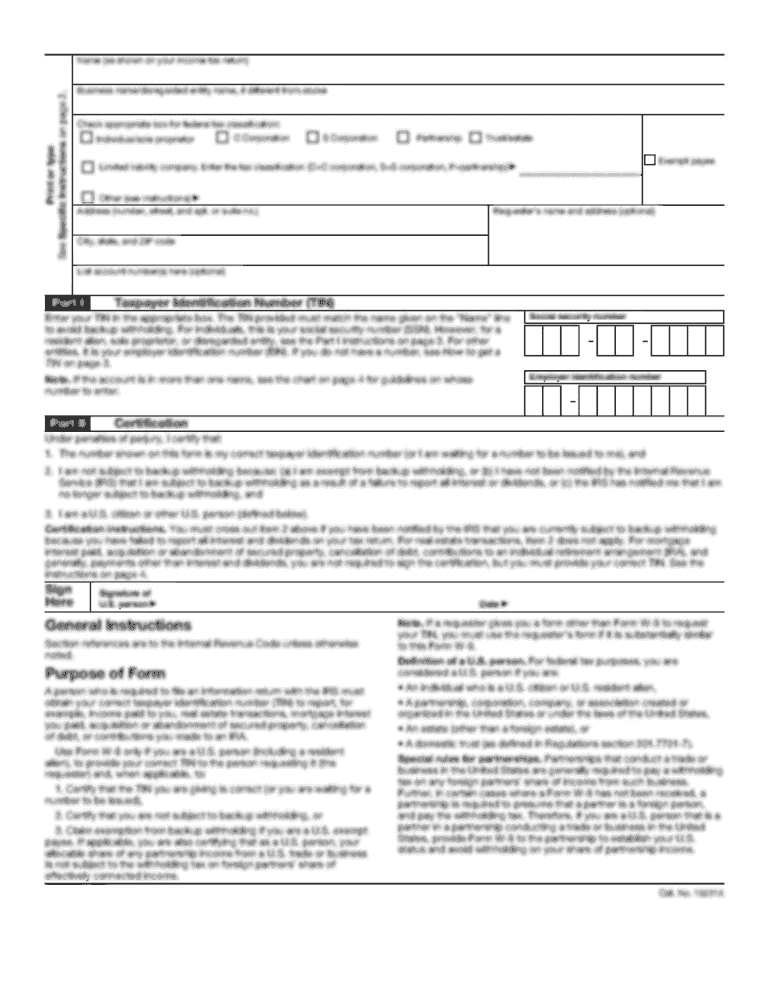

Who is required to file de9adj?

DE9ADJ is a form used by employers in California to reconcile discrepancies between the wages reported on the quarterly wage and withholding reports (DE 9) and the wages reported on employees' individual wage statements (W-2 or 1099 forms).

Employers who are required to file a DE9 (Employer's Quarterly Contribution Return and Report of Wages) and have discrepancies between their DE9 and employee wage statements are required to file a DE9ADJ. This form allows employers to correct any discrepancies and ensure that accurate wage information is reported to the Employment Development Department (EDD) in California.

How to fill out de9adj?

To fill out DE9ADJ, also known as the California Quarterly Contribution Return and Report of Wages, follow these steps:

1. Download the DE9ADJ form from the Employment Development Department (EDD) website or obtain a physical copy from an EDD office.

2. Fill in the employer's name, address, and employer account number.

3. Indicate the quarter and year for which you are filing the report.

4. Section A: Report of Wages Paid, State Disability Insurance (SDI) and Employment Training Tax (ETT)

- Enter the total wages paid during the quarter for each employee subject to SDI and ETT taxes. Include their Social Security numbers and checkmarks for the applicable boxes.

- Report the wages for each quarter in the appropriate columns for SDI and ETT.

- Calculate the SDI and ETT amounts by multiplying the SDI rate (currently 1.2%) and ETT rate (currently 0.1%) by the wages paid.

- Enter the total SDI and ETT amounts in the appropriate boxes.

- Total the columns and enter the sum.

- Sign the certification statement at the bottom of Section A.

5. Section B: Report of Taxable Wages, State Unemployment Insurance (SUI)

- Enter the total taxable wages paid during the quarter for each employee.

- Report the wages for each quarter in the appropriate columns for SUI.

- Calculate the SUI amounts by multiplying the SUI rate (varies annually) by the taxable wages.

- Enter the total SUI amounts in the appropriate boxes.

- Total the columns and enter the sum.

- Sign the certification statement at the bottom of Section B.

6. Section C: Adjustments

- Report any adjustments to wages, SDI, ETT, or SUI from previous quarters, if applicable. Provide explanations for each adjustment.

7. Section D: Transmittal and Payment

- Fill in the employer's name, address, and account number in the Transmittal and Payment section.

- Calculate the total amount of contributions due for the quarter by adding the SDI, ETT, and SUI amounts.

- Enter any total previously paid and any remaining balance.

- Indicate the payment method and provide the necessary information.

- Sign and date the form.

8. Keep a copy of the completed DE9ADJ form for your records.

9. Submit the completed form to the EDD along with the required payment, if applicable. The address for submission is provided on the DE9ADJ form.

Note: It is important to check the EDD website or seek professional advice for the most up-to-date information and instructions on filling out the DE9ADJ form, as the instructions and rates may change over time.

What is the purpose of de9adj?

DE9ADJ is a continuous improvement model that stands for Define, Explore, Generate, Adapt, Decide, and Justify. It is commonly used in Six Sigma and Lean methodologies to guide problem-solving and decision-making processes. Each step in the DE9ADJ model focuses on a specific activity that helps analyze and resolve issues effectively. The purpose of DE9ADJ is to provide a structured approach for problem-solving, ensuring that all relevant factors are considered, and decisions are well-justified.

What information must be reported on de9adj?

DE9ADJ is a form used in California to report adjustments to payroll taxes. The following information must be reported on DE9ADJ:

1. Employer Information: This includes the employer's legal name, address, and employer identification number (EIN).

2. Quarterly Reporting Period: The form requires the reporting of adjustments for a specific calendar year and quarter. This includes indicating the quarter for which the adjustment is being made (e.g., Q1, Q2, etc.) and the corresponding year.

3. Total Wages: The form requires reporting the total wages subject to California withholding and the corresponding Social Security and Medicare wages for the specific quarter being adjusted.

4. Withholding Adjustments: Any adjustments to state income tax withholding must be reported. This includes reporting the additional state income tax withholding (if any) as well as any refunds of excess state income tax withholding.

5. Disability Insurance (DI) Adjustments: If there are any adjustments to Disability Insurance (DI) withholding, they must be reported here. This includes reporting any additional DI withholding or refunds of excess DI withholding.

6. Personal Income Tax (PIT) Withheld Adjustments: Any adjustments to Personal Income Tax (PIT) withholding must be reported, including any additional PIT withholding or refunds of excess PIT withholding.

7. Employment Training Tax (ETT) Adjustments: If there are any adjustments to Employment Training Tax (ETT), they must be reported. This includes reporting the additional ETT or refunds of excess ETT.

8. State Disability Insurance (SDI) Adjustments: Any adjustments to State Disability Insurance (SDI) withholding must be reported, including any additional SDI withholding or refunds of excess SDI withholding.

It is important to accurately report all adjustments on the DE9ADJ form to ensure accurate tax filings and avoid any discrepancies with the California Employment Development Department (EDD).

When is the deadline to file de9adj in 2023?

The deadline to file DE9ADJ for the year 2023 will likely be January 31, 2024. However, it's always recommended to double-check with the tax authorities or a tax professional for the most accurate and up-to-date information on filing deadlines.

What is the penalty for the late filing of de9adj?

The penalty for the late filing of DE9ADJ (California Quarterly Contribution Return and Report of Wages) can vary depending on the specific circumstances and the duration of the delay. Generally, the penalty is assessed as a percentage of the contributions due on the report, and the amount increases with the length of the delay. Additionally, interest may be charged on any late payments. It is recommended to refer to the official guidelines provided by the California Employment Development Department (EDD) or consult with a tax professional for the most accurate and up-to-date information regarding penalties for late filing.

Where do I find de9adj?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific de9adj instructions form and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I complete de 9adj online?

pdfFiller has made filling out and eSigning de9adj 2019 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How can I fill out fillable de9adj on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your form de9adj, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your de9adj form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

De 9adj is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.